Hi Everyone,

I hope you all had a wonderful week. On a personal side, we started planting seeds for our summer gardens and already see some great results with our future radishes, cucumber, carrots, beans, peas, onions, beets, and so on. This should give me ample time to fabricate some raised beds while the temperature slowly creeps upwards to 20 degrees here in Ireland. I am also 90% sure that my neighbor has chickens in his backyard, which I would like to have myself. We also purchase very long-term investments by buying an Apple, a Pear, and a Prune tree. See you in 5 years or so.

Today, we will be exploring the fundamentals of Uranium investing. Just like many other commodities, Uranium has been left for dead in the past 10 years. It is about to come back on the mainstream investment shows and portfolios and soon be the town's talk. Therefore, here is my top reasons to invests in Uranium:

Supply & Demand imbalance

Consistent lack of Capex investment

Price of uranium

As you can see, I am a simple man. I like an investment thesis that is easy to understand.

Supply Depletion

This is not your typical “peak oil” supply depletion. This is a factual, quantifiable, and auditable fact. The below table, provided by TD securities, shows us all the current and future uranium supply by their sources. The interesting fact is the total western mine supply keeps declining year after year. I like the below table because it goes into a lot of detail about the different sources of supply.

Uranium bulls were already hyped up about this thesis 3 years ago. The big unknown in the last couple of years highlighted by Mike Alkin from the hedge fund Sachem Cove, the only hedge fund focused on Uranium investing, was the secondary supply from, as an example, Japan. After the Fukushima accident, they were selling the uranium they did not need from the excess inventory they had contracted because they decommissioned nuclear reactors. This, however, is/will soon be coming to an end, and all we will be left with will be a primary supply which is even easier to forecast given that only a few mines in the world produce uranium. If you really want to get deep into the subject, I suggest the following interviews. It is 2 hours long; therefore, that is if you really want to get deep into the subject! I could spend a full article on the secondary supply dynamics. Is that something you would like to understand? Drop me a comment below:

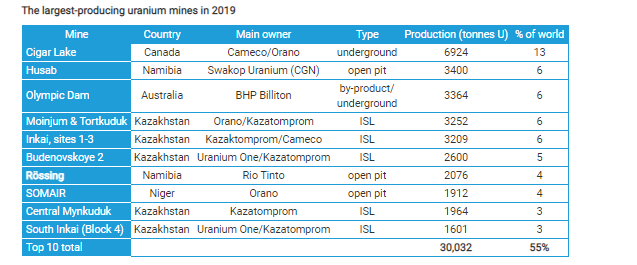

Covid 19

Since 2020, we have further eroded the supply of current mines. As you can see from the below table, the uranium-producing companies are very concentrated. Cameco and Kazatomprom, the biggest producers globally, have both decided to leave some of their production mines offline for the foreseeable future. Cameco, in 2018, put their McArthur River mine in care and maintenance. They said that the closure was due to Uranium's ongoing low prices and would bring it back in production only when the price would justify it. Kazatomprom, the biggest producer in the world, in their latest earnings call, mentioned that they were most probably going to have to buy uranium on the spot market, meaning at the open market, instead of depleting their mines. In my opinion, this strategy is fantastic news to drive the price up in the future as it will deplete all the secondary supply and force future prices to increase as it squeezes the current supply even more. Looking further to the list of major uranium producers, BHP, last year, decided to stop expanding their Olympic dam mine. Not including this list is the Cominak mine from Orano that will stop its production in March this year.

Demand Imbalance

As mentioned last week, the current total number of nuclear reactors is 440. We will add another 50 reactors that are either being built or contracted by 2025. China, by 2030 will be consuming the total current production of Uranium alone. The big question will be, where will the future supply come from? Twofold, first, mines that are currently on care and maintenance. What the hell does that mean? Mines that are uneconomic at the current price of the uranium but would produce at higher prices. Paladin and Cameco have such mines. The issue of having to restart mines is that it is costly. I feel I repeat myself as we move from one commodity to another, but you cannot simply turn a switch on and off to produce more Uranium/silver/gold/copper/lithium/rhodium and so forth. The projected costs to restart the Paladin mine is 81 million dollars for their Namibian mine.

On the above graph, you can see that the returning production will cover some of the supply/demand imbalance. As we move into the latter part of the decade, however, we will need a secondary inventory source, which will be through new mines productions. John Quakes provided the above graph.

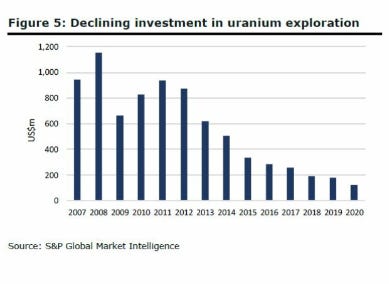

Lack of Investments

The countercyclical nature of commodities investment is usually a simple path to follow. A period of high prices leads to a lot of investment in future productions. This, in turn, will lead to higher production and, in the absence of higher consumption, will lead to lower prices of the said commodity because of the excess supply. If allowed to persist for a prolonged period of time, this situation will lead to a shortage of supply, which is exactly what has happened since Fukushima. So what is the current state of Capital investments in Uranium, you ask? In the chart below, we can see that we are between 20% to 25% of what we used to invest 10 years ago. Given the shrinking supply and the lack of investment to bring new mines to life, this will lead to higher uranium prices. In fact, I think we will see a sustained higher price of Uranium for a much longer period of time following this period of under-investment given the forecasted rising demand in the next 20 years.

The price of Uranium

The price of uranium has been quite stable since 2015, staying below 30$/lbs. Unfortunately, only the best and most productive mines can make a profit with these prices. Looking at the below table, although this is the USA only, it gives you a great understanding of what supply can be mined by price point. Under 30/lbs, there is very little supply that can be mined profitably, as you can see.

Uranium Price chart

If you look at the new projects from future mines for companies that have confirmed resources in the ground, you find that companies will be profitable and able to operate mines with a constant and long-term minimum price of uranium 50/lbs. One of the reasons why the price needs to be significantly higher than the current 30$/lbs is that these companies will need to spend a minimum of 5 years on building a mine and potentially spending upwards of 1 billion dollars in CAPEX. Let pause here for a second. If this was your own money, would you sign contracts with builders, contractors, engage with the governments for environmental studies, knowing that you would ultimately spend 1 billion dollars if you cannot, with a reasonable level of certainty, predict that you would be making a profit? Furthermore, utilities who buy the uranium are price takers and have inelastic price demand for the fuel. Why is that? Utilities, which are usually government entities or government allowed monopolies need to keep the lights on, regardless of the price they pay for the commodity. From last week’s article, we know that nuclear reactors produce 10% of the world's electricity, and sometimes close to 30% of a country’s total electricity is provided by nuclear.

Summary

Unless another accident like Fukushima happens in the near term, I think that Uranium equities will end up being the best-performing asset of 2020 to 2030 on a risk-adjusted basis. Before you castrate me for not mentioning Bitcoin, I still think we will see another 10x to maybe 20x from the current price. Some of the junior equities will be able to achieve 10x to 50x in the next 10 years and repeat some of the actions that we saw in the late 2000’s bull market. Of course, some start-ups could IPO and give you 10000% return over the next 10 years. A pharma could cure cancer and do the same. Uranium's difference is that even the biggest and best in class, blue-chip companies with solid management, years of experience will experience an easy 10x increase in market cap. The smaller producers will probably experience a 20x increase in market cap. Simultaneously, the grass-root explorer and project generator might repeat the Paladin story that went from 0.04$ a share all the way up to 10$ per share for a whooping 250x times your money.

Update on the portfolio

I have highlighted in yellow the uranium part of my portfolio—a couple of things to notice since the last update. I have decreased the number of holdings significantly because of poor drill results, lack of news flow, and or management’s responsiveness to my inquiries. If we go back to my original thesis on Silver/uranium and gold investment, many of the smaller explorers I held did not perform well because they did not find what they were looking for. When this happens, it is time to pack your bags and move to companies who have delivered on their promise to find ore in the ground. I also had the opportunity to speak to Mining Ceos in the last 2 weeks. From now on, I will try to incorporate either interviews or part of our conversation for your benefit. I also will have a few spots available in the coming weeks for more of these. If this is of interest to you either to listen in and or even ask questions, drop me a note, and I will try and include as many people in the next call as possible.

Thanks for reading, and don’t forget to leave your comments here below! What should we talk about next? Deeper in the Uranium thesis? Copper? Battery metals? What do you want to hear about next?

Max

Amazing article! The information you are providing is so precious to a guy like me. I got interested in investing in the mining industry recently because I strongly believe that oil will be replaced by different metals in the next decade because of the rise of EV and the need to move to alternative energy sources and storage of renewable energy like solar and wind.

I am also a strong believer in nuclear energy and I hope that the next decade will be a pivotal decade bringing new discoveries and a renewed interest toward this energy.

Thanks for helping us to understand this mining world and all the investments possibilities!

Hi

Great article. Which small cap uranium equity plays do you think are most likely to go 20x to 50x over this decade from the list highlighted in yellow?

I already own Cameco but that is the blue-chip in the sector.