Hello friends,

I hope you had a nice weekend. I did not publish an article last week as we finally moved into our permanent house in beautiful Malahide, near Dublin, in Ireland. The move went smooth and we are now happy that our son can sleep in his own room, daddy can work in his dedicated office, and my wife can enjoy an additional 2 hours of stress-free sleep in the morning!

In today’s installment, we will discuss why nuclear is the best baseload energy for the future and why it’s a great financial investment. I usually have 3 reasons but I will add a 4th one today given the exciting news of yesterday.

It is safe

It is constant

Smallest footprint of all energy sources

Companies are buying physical uranium

Lesson from Germany

After Fukushima, Germany went on a shopping spree for renewables energy while making a public engagement of decommissioning their nuclear reactors by 2022. The idea was to move as far away from nuclear after the Fukushima incident. Based on a premise that nuclear energy was still dangerous, a misconception, in my opinion, has led them to replace part of their clean baseload energy from nuclear with a far more environmentally questionable source of energy, Coal, which will only be decommissioned by 2038. Everyone should learn from Germany and not repeat their mistake detailed in this article.

Is Uranium Safe?

I received this message, half-jokingly, today about uranium: “how do I get my hands on said uranium without endangering my inner reproductive organs?”. This sums well the last 40 years of media coverage about uranium. What is the reality? Below are the biggest nuclear accidents. Let us explore them in a bit more detail.

Chernobyl

3-mile island

Fukushima

Chernobyl had a flawed design and no backup generator test and ill-trained personnel. This incident was tragic and there was massive repercussion to about 4000 people. The 3-mile Island was caused by the loss of coolant and also had technical flaws in the design. Fukushima, was not so much a nuclear accident as it was a tsunami that caused people to drown. I do not was to diminish the loss of lives and the effects that first-generation nuclear reactors had on the affected populations. My aim here is to contextualize the loss of lives due to nuclear accidents. The list of all incidents is listed here and does not represent more than 4500 maximum deaths in the history of nuclear energy. To summarize, nuclear reactors provide anywhere between 20% to 30% of total electricity in certain countries, 10% in the world, and have been effectively doing so for the last 60 years. The total direct and indirect loss of life, notwithstanding the nuclear bombs, is relatively small compared to deaths from the pollution of coal, oil, and natural gas. The guardian, in this article, claims that potentially 8.7 million people died from the pollution caused by fossil fuels such as oil and coal in 2018 alone. What do you think?

Is it constant?

The simple answer is yes. One of the biggest issues with solar and wind technology is that they are not constant and create electric grid issues. Solar does not produce during night time and there is inadequate amount sunlight in the northern part of Europe where a big concentration of population lives making it less than perfect for these regions. As for the wind, it also is not constant and highly dependant on nature. It also creates issues of visual pollution, disturbs locals birds, and fish.

What is the energy footprint of nuclear?

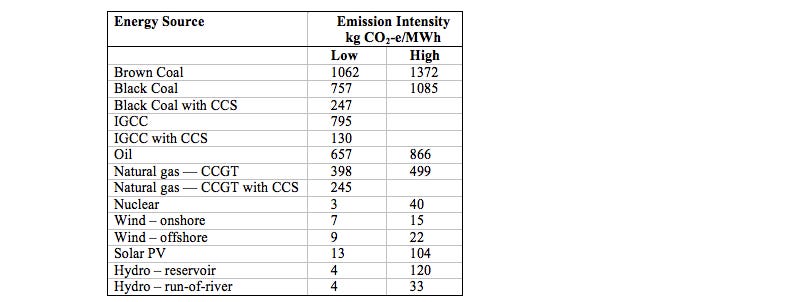

Minning uranium, as well as the construction of the nuclear reactors, are not free from disturbing the local population, water resources, wildlife as well as being very energy-intensive. The same can be said for the production of wind turbines which require a lot of fossil fuels and the mining of minerals for solar panels. Unfortunately, no energy source is perfect. There are drawbacks to each. The question is which one produces the greatest amount of energy output with the smallest amount of energy input? The below table summarizes the life emission of all energy sources. Wind Turbines are even better than nuclear, however, as mentioned earlier, the reliability issue from wind makes it less desirable than nuclear which have constant power output. All graphs were obtained from this great resource.

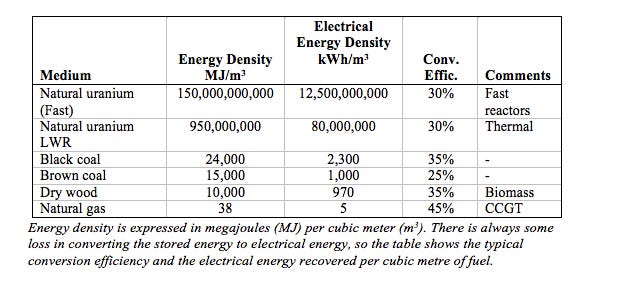

To top it off, nuclear is the densest form of energy that we can use to generate electricity. ( Note below, the higher the better )

The Go signal

As mentioned in January, I am wildly bullish on uranium equities. The time is ripe for governments to invest in clean energy sources. We had a great rally in uranium equities since last year as depicted in the below graph that tracks the uranium producer ETF URNM. The ROI since inception is over 100% which is great news.

This is interesting since the price of uranium has not increased significantly, from 24$/lbs to 27$/lbs, since last year and means that it is only driven by investors believing in the narrative and positioning early in the cycle.

Yesterday, Denison mines, a uranium pre-producer, meaning a company that does not yet produce uranium but is developing a mine that will come online later in this decade, decided to raise 75 million dollars, through additional share issuance, to purchase physical uranium. This news is HUGE as this is not common practice. The use of funds from pre-producer are usually used to further the development of the mine. If I read between the lines, I can only assume that the management of Denison Mines thinks that physical uranium is worth more to hold than cash and most probably, we can infer that the price of uranium will increase significantly in the future. I could speculate that uranium players are trying to corner the market and force utilities to contract with the producer at higher prices in order to make their future production profitable but I have no proof of that. It would however make a lot of sense as this was a strategy used by hedge funds in the last bull market from 2003 to 2008. I foresee a great future for uranium equities!

How do you see this? Do you feel excited about the uranium market? Are you invested in uranium?

Max

Are hated assets a good investment? In case of Uranium I would agree.