What a crazy time we live in. Not a single day goes by since march 2020 that I don’t think about this. The last two weeks have been no different and I think we need to go over the “blow by blow”, to use a boxing analogy, of what happened in England and what it entails for the market in the coming months.

Instead of going over where we are with the portfolio, this post will be about understanding the ever-present financial leverage in our system…We like to cajole ourselves that 2008 was a once-in-a-lifetime event that we will never see again.. Not saying we will but the leverage that existed, albeit in a different pocket of the market, still exists today and as we saw in England, can threaten the stability of our system at any given point in time. Also, something different this time around, we have a video format for the blog. Let me know if you like this!

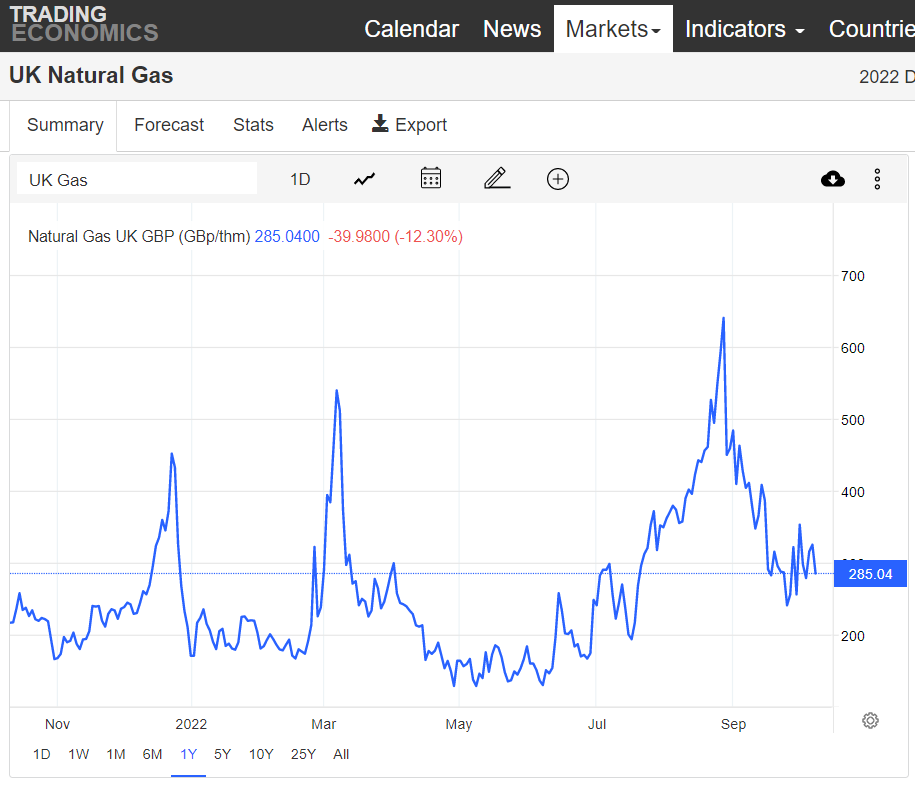

Let us recap the events before we delve into details. Liz Truss was named PM in England on September 4th. In the following two weeks, responding to the cost of living increase, she proposed to freeze the energy price

which was going to increase the average family energy cost by approximately $4000 a year or roughly 10%-20% of their disposable income. She further presented tax cuts representing at the time about 60billion sterling pounds. As you can see from the below response on the sterling pound to US dollar exchange rate and the value of the UK government 10-year bond ( they call them Guilt), the markets did not approve of her plan.

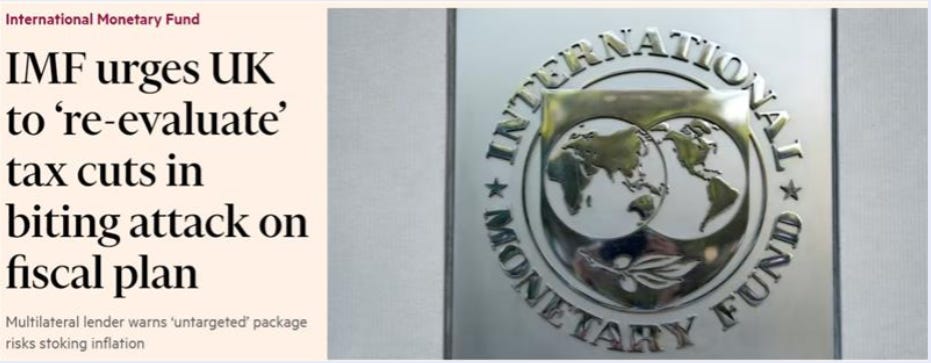

On the 19th of September, I was causally chatting with a colleague about the selective forgetful memory the UK government had and should recall that the International monetary fund had somewhat similarly bailed out the UK in 1976.. A few days later, JP Morgan on one of the morning call briefings was also cautioning of the same fatal tale.. Leading to Wednesday 28th FT article in the morning

and the further update later that day

The final act of this debacle, for the moment, has been a u-turn from the Truss government on some of the proposed tax cuts and approval ratings that are below her predecessor Boris Johnson.

A little primer before we can

The twin deficit

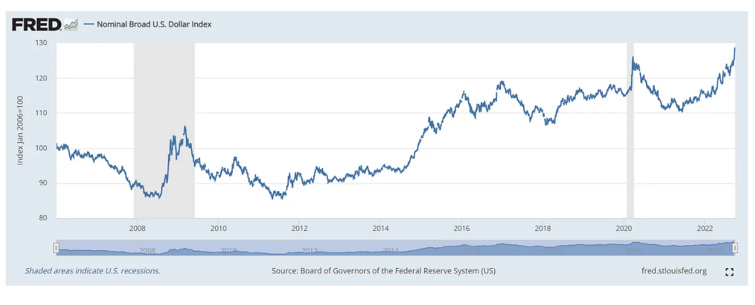

Every country in the world either exports more goods and services than they import or vice versa. If a country imports more than they export, we say that they run a current account deficit or that they have a negative trade balance. England is such a country and it is important because it means that more sterling pounds are sold in order to buy the import of goods such as oil&gas which are priced in US dollars. This usually puts pressure on the downside of the currency and on a sufficiently long time horizon decreases the relative value of the currency. This in itself is not inherently good or bad. The second deficit is the fiscal one where a country spends more than they collect in revenue from taxes. In order to finance the deficit, governments around the world need to issue bonds to finance these deficits. We could argue that as a standalone deficit, both of these are manageable however coupled together, they usually become a problem for the country relatively fast. Why is that? As a function of the negative trade balance, foreigners need to recycle their foreign currency which they usually do in the form of buying foreign government bonds. If however, foreigners know that they can get a higher interest rate in another country's bond priced in another currency, all else equal, they will prefer that. And unless you have been living under a rock, you might have heard that the central bank in the USA has been increasing the interest rate at a never seen before pace. The Bank of England has been forced to play catch-up since May.

Who buys government bonds? Hedge funds, other governments, individuals, and pension funds. Especially the ones that are defined benefit or in the UK are called liability-driven pension funds. These work by guaranteeing a percentage of salary to pensioners at a later date. These pension funds face a lot of risks since they need to create a good return to satisfy their future liabilities. Their portfolio is made up of bonds and stocks. Gilts are interesting because they are good collateral, meaning you can use them to borrow money to invest more than you currently have assets. They also have fixed interest payments which makes them great to match future outflows or payments to pensioners. The pension funds also resort to many tactics to generate returns, especially in an environment where rates were low for a long time. One tactic is an interest rate swap. Complicated to understand but follow here for the ABC on it. To keep it simple, these contracts necessitate little to no exchange of cash aka more leverage in the system. In the case of the pension funds, for a long time, since the interest rate was going down, they probably benefited. As the interest rate this year began, they probably started to make payments to the counterparty( it might not be as easy as this but the fact that the liquidity in those bonds was freezing up suggests something as such). Bonds losing value, having to post collateral for the swaps and the very thing they use for collateral is being devalued rapidly.. not a great combination..

A few last points.. Trade weighted dollar keeps going up. How many more corners of the world economy have levered up and are in dying pain every day?? Who holds the counterparty risk to the pension assets? Is there a contagion risk to the broader economy?

Last week, the chancellor of the exchequer was forced to resign… Hardly a surprise to anyone following this (Hello Brian)

Where is the Gilt and the exchange rate of USD/GBP now? Lower and lower. If I was a betting man, the exchange rate is the one that goes. We simply have too many historical precedents here. Too costly politically to let go of the bond market, meaning more interventions from the BOE will be needed, whereas probably only British pensioners/vacationers will be mad about the loss of the purchasing power of the GBP.

On the portfolio front, still holding on to the Uranium bull market. It is holding pretty well given the broader market weakness. Bough into a private lithium company that will go public next year and also a silver company that started production and should be cashflow positive in Q4 2022. I still think resources are the way to go in the long run. Bonds will be an absolute banger in a couple of months as well.

Stay safe out there!

max

The pound sterling, the Gilt and Forex market