Hi Everyone,

I hope you all had a nice week. The markets were roaring once again to all-time highs giving much hope to participants that the worse of the pandemic is behind us and that the “pent up” demand on leisure goods such as travel tourism and the hotel industry might see better days ahead.

After a couple of articles explaining the uranium thesis, I thought we could switch up gears a little and look at another play on the inflation trade that also plays on the electrification of the world. Somewhat like we did in the part for silver, gold, and uranium, I would like to explain the copper opportunity as follows:

Supply

Demand

Price

Politics

Supply

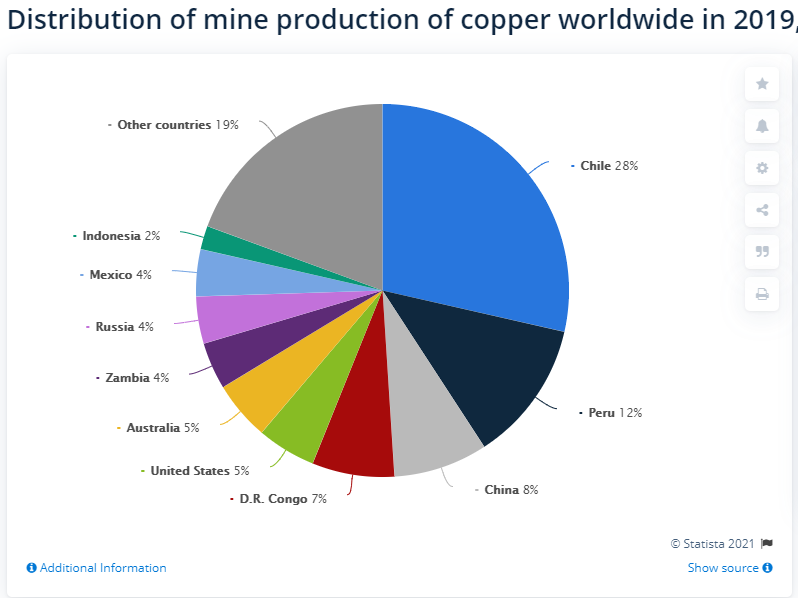

Chile and Peru are the world-leading Copper production countries in the world. The biggest copper mine in the world is owned by BHP and operated in Chile. One common recurring theme in my columns is how I stress the fact that non-renewable resources in general, keep decreasing in grade over the last 100 years. What do I mean by that? At the turn of the 19th century, copper was found in surface rocks with a concentration of 20%. By Early 1900, that concentration was now around 10%. The best concentration in the world now is at 4%-5% and the major project being worked on are below 1% concentration. Ok Max, thanks for the history lesson but why should I care? Great questions I might add. The concentration of any resource has an inverse relationship to its cost of production. The higher the concentration, the lower the cost of production is for that same resource everything else being equal. By now, I made you realize that with decreasing grades, something else must be true and that is that the future cost of production of copper will increase given the decreasing grade. One aspect of this truth is however is that we must not see the inevitability of increasing cost of production with the sudden increase in the copper price. One mining veteran, Doug Casey, repeatedly says in interviews that if you stumble on a resource where the price is lower or equal to the cost of production, while you might have to wait for the price to rise, you have found a great investment niche. If most of the copper miners will have a production cost of +4$/lbs for new mines, it must be that the price of copper will need to increase to that level if we ever want to get it out of the ground. I caution readers here. The mining industry will give you projections of copper production price in the 2.50$ to 3$ range these days for new mines. The caveat to these cash costs as they are often referred to is that it does not include start-up CAPEX and does not include general and administrative costs of running a company. Finally, these new mines usually come with a start-up capital needed north of 500 million to sometimes 1.5 billion just to get the mine in operation. You better believe that if a Rio Tinto or BHP starts a new copper mine and needs to invest this vast amount of money, they will only do it with the certainty to provide a nice return on capital employed (ROCE)to their shareholders.

Demand

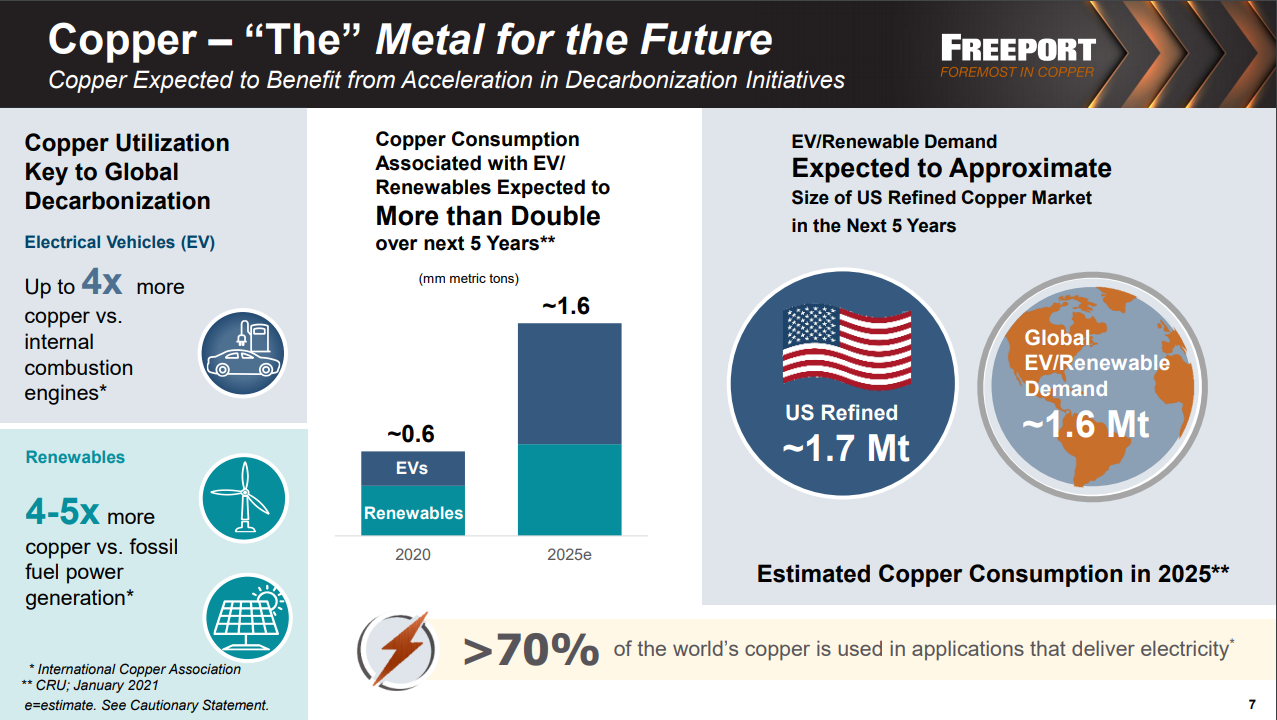

I took out a self-serving slide from Freeport MacMoran corporate presentation, the largest Mining company on the SP500 index last time I checked, to help visualize the increased demand for copper in the future. I do like to linger too much on the demand side of the equation because that becomes the “if” in the investment thesis. We would fare much better with our investment returns, in my opinion, if we would consider the more reliable supply picture and look at the potential increase in demand as a nice perk. Copper is on everybody’s radar for obvious reasons. It is the basic material that will enable the global effort to electrify the grid, help us take out the internal combustion engine off the road by increasing the amount of electric/hybrid vehicles, and finally is needed in basic home construction. With the population growing to 9-10 billion in a not-so-distant future, the green push from the Biden administration leading the way for others in the world in general to advance the green agenda, the increase in demand looks like a safe assumption.

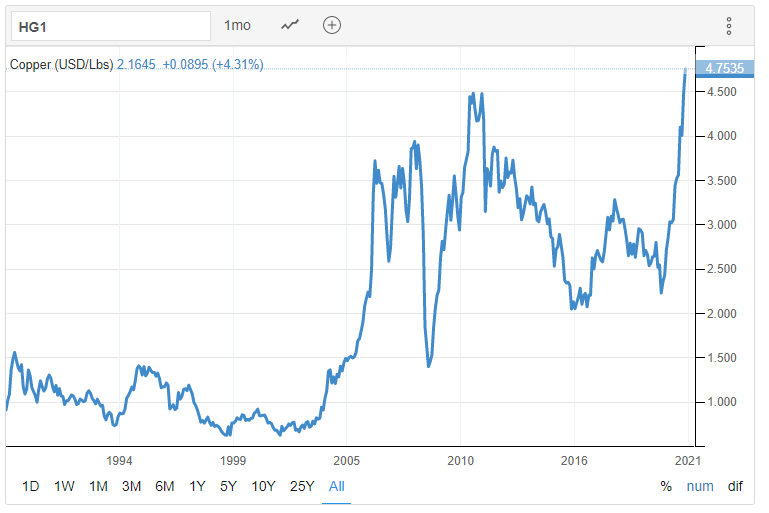

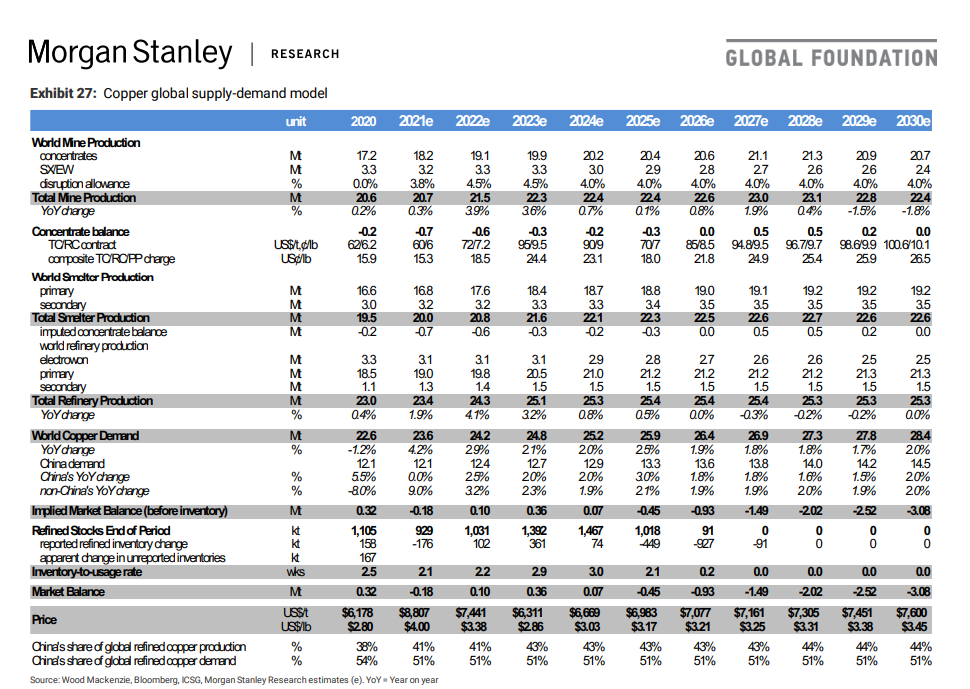

Price

Our Friends at Morgan Stanley have been gracious enough to provide a supply/demand/price outlook for copper. With supply shortage until 2022 and a real supply deficit as of 2025, the tailwind that we have seen in the last 12 months looks poised to continue in strength for another 12 months. I interviewed a couple of copper mining CEOs in the past months and the recurring theme for them is the need to have copper above 4$ to entice new mine supply. Now, let’s take a bear case to our proposition for a second. Let’s imagine that this rally in price is extended and too much of a no-brainer at this point. I can already imagine Patrick Ceresna and Kevin Muir from the podcast market huddle discussing next week, just how much higher can the price of copper get?? Fine, let’s imagine we come back to a normalized price of 3.5$ or even 3$. This would most probably slow down the current investment in new drills and mining development that is currently happening. Banks would get frisky and projects would stall. Fine, no really, equities will retreat and everyone will get bummed down for 12-24 months. And then what.. It’s the elastic effect, come the end of 2024 when there are no new mines available to produce new copper cathodes. What then? Would we turn off the lights? Would we stop building new houses? Waiting longer will only increase the price further to the upside. I think I already wrote here 100 times how impossible it is for the mining industry to flick a switch and turn on a new supply. It takes years, permits, drilling, investments for companies to develop these projects. Maybe plus 4$ copper is not here to stay for long but +4$ copper is here to stay in the longer term if we do not see the corresponding investment in this industry.

Geopolitics

A couple of interesting headlines came to my radar in the last weeks. Starting from the imminent election of a less than friendly government for mining in Peru. I would not be able to judge on the merit of the proposed increase in taxation from the left-leaning labour activist now turned president but this will have a ripple effect in the mining circle. Executives do not like instability and that will affect investment decisions. I found this article helpful to understand the situation. In chile, BHP is in a negotiation lockdown with their employees at the Escondida mine. In Kyrgyzstan, the government is threatening Centerra mining with a 3.1 billion fine and a possible government takeover. The recent events in Columbia and South America makes the supply certainty much less certain and will at the very least be discussed on company boards as an added business risk. Final point on the geopolitics front, every country in the world has spent significant sums of money during this pandemic to help affected workers. With the increase in price of commodities, adding taxes to the mining sector, especially in countries where a large part of the governments revenues is driven by levying taxes on ore mining, seems like a no brainer. This also should affect the cost of capital and the return on equity in these jurisdiction.

The bottom line

We all agree, I think, that copper has had a fantastic run up in the last year. I do not own a crystal ball but I am confident in the long term outlook of copper for 3 reasons (shoutout to McKinsey and my MBA classes )

Decreasing concentration in copper ore

Increased cost of production in copper ore

Long-term supply demand/imbalance

that being said, I would caution anyone out there venturing in copper to strategically allocate any funds you deploy to copper. The current 2x to 10x in equity prices since March 2020 is indicative that the market has already price in a lot of the news I discussed in this article.

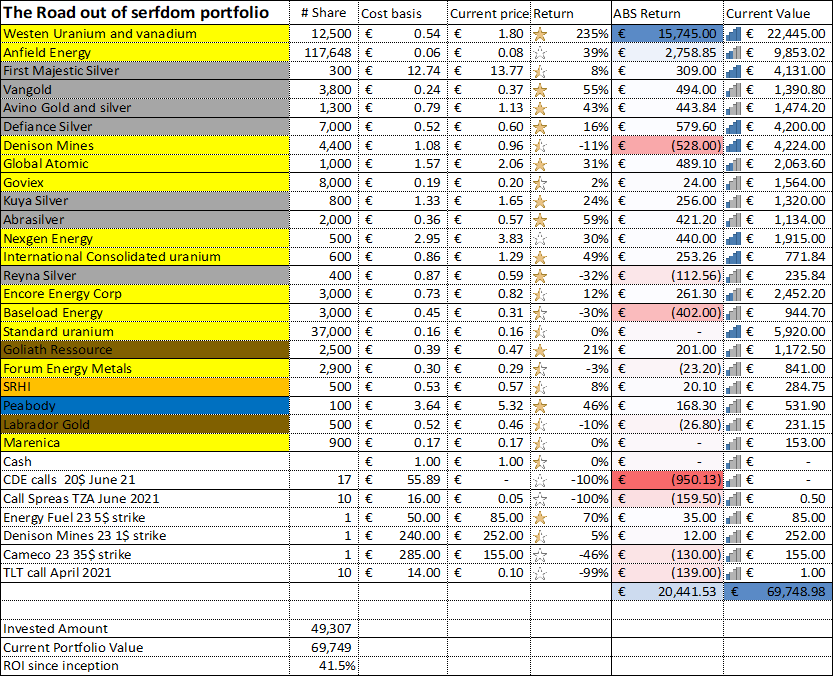

Our portfolio

A couple of noteworthy addition to the portfolio. While I do not endorse the environment effect it has, I added position in Coal through the company Peabody energy.A full write up of the thesis is in the making. I added the copper junior miner SRHI, I added the gold explorer labrador gold and the Uranium Developper Marenica Energy. As you can see, these positions are very small and do not reflect my full position yet. I decided to enter 25% of my desired position. This strategy is to ensure that if the price were to go down after my initial purchase, I could average the rest of the position at a lower price. In the case of Peabody and SRHI, this does not seem likely to happen with a sudden 8% and 45% increase in price. I also am finalizing a private placement with Anfield Energy, a uranium producer/developper. Looking at our position in Western Uranium, I believe there are further catalyst to the growth of the company even if it has already runned up 235% since my acquisition. The potential inclusion in the Russel 2000 at the beginning of May and the potential inclusion into URA exchange traded fund in June/July. My initial thesis was that they would get acquired by none other than Energy Fuel to help them become the “big dog” in the USA Uranium landscape. I also have warrants ( same as options) to double my position at a price of CAD1.20$. So far, this is the gift that keeps on giving. On the biggest drag to the portfolio, you can see that my lottery bet on Coeur de mining calls for June will most probably expire worthless. In hindsight, I could have played this better. My protection against a market crash seems likely to also expire worthless. This however was meant to protect on the downside which means I am also quite happy that I have not needed it so far.

On the news front, the blog will also start featuring the interviews I make with CEOs. I am working out the details but will keep everyone posted. If you are interested in joining one of these calls, either to listen in or ask questions, I have schedule for may the 27th a company called Troilus Gold which is exploring for Gold in my native Quebec land. With the recent break above 1800$/ounce of gold price, it seems perfectly time to have a second look at gold mining equities. These guys have strong backing from the government, sprott and insider ownership above 10%. Send me an email to participate.

I always welcome all your comments, tips and recommendations. Keep them coming.

Max

How does MS come up with a Cu price around $3 despite forecasting a sustained supply deficit?

Are you following the graphite mining industry as well? I would love to hear your opinion on this sector. I have a good portion of my portfolio in NOU.V I really like this company and how they approach their project. But I might be biased because it is a Quebec company. I would really like to have your take on this company